Commodities and industrials: Quick chemicals, flat steel

Chemicals producer BASF has flagged that shipping conditions are still influencing its supply chain decisions as “for certain port pairs we still do not have the reliability we would like to have, which is needed to reduce our working capital and our stocks.”

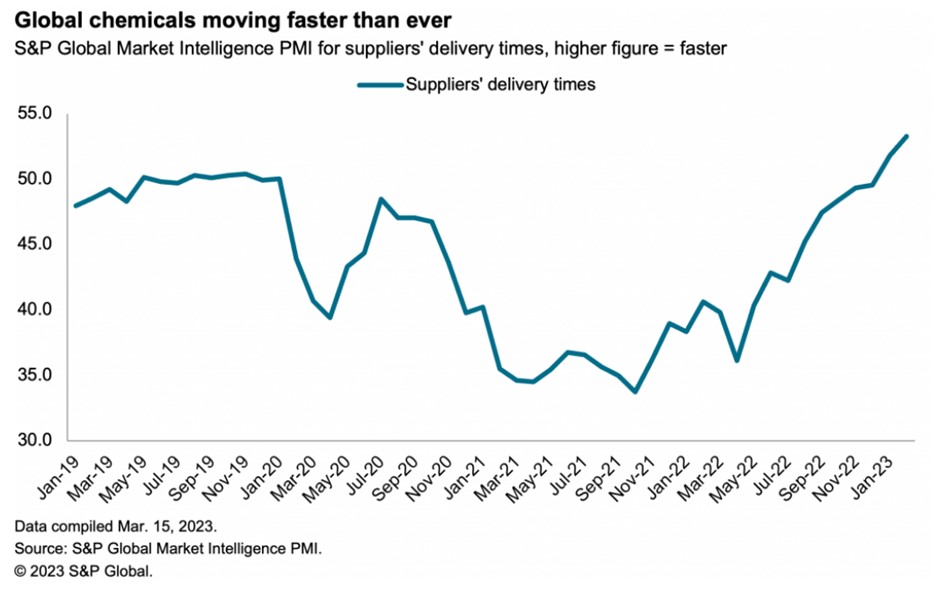

– While BASF has reliability concerns, the pace of deliveries of chemicals globally appears to have picked up. The S&P Global Market Intelligence PMI measure of suppliers’ delivery times for the global chemicals industry has improved every month since July 2022 and reached its highest (i.e., fastest) since the series started (October 2009) in the February 2023 survey.

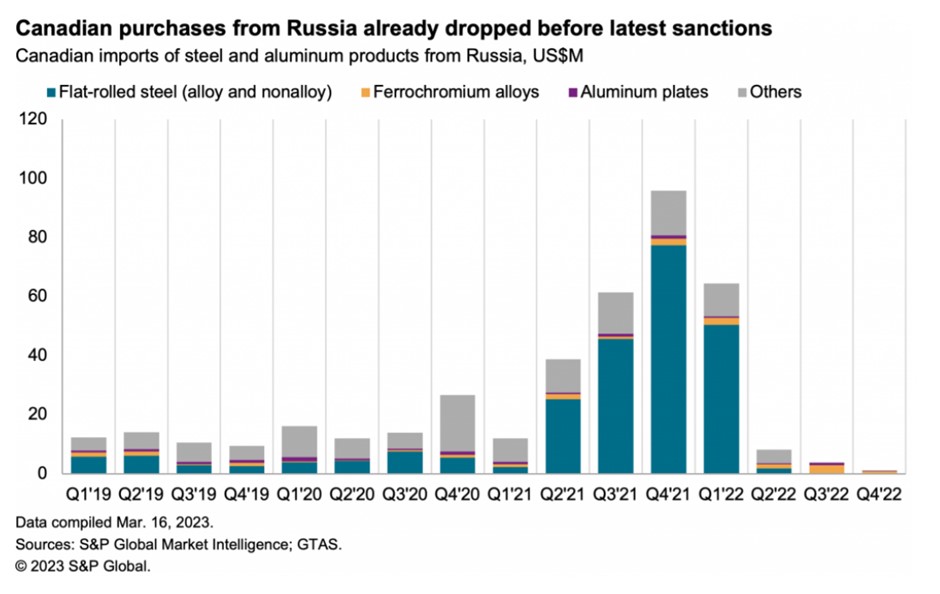

The Canadian government has banned all steel and aluminum imports from Russia as part of sanctions linked to the Russia-Ukraine war. Shipments had already fallen precipitously, likely owing to Canadian firms looking to mitigate their sanctions risk.

– S&P Global Market Intelligence GTAS data shows Canadian imports of steel and aluminum from Russia already fell from a peak of $96 million in the fourth quarter of 2021 to just $1.2 million in the fourth quarter of 2022. Shipments of flat-rolled steel (both alloy and nonalloy) represented most of the drop, with the main remaining shipments being ferrochrome products

– Turkey has terminated transit of sanctioned Russian goods, according to S&P Global Market Intelligence Country Risk research . That may restrict, but not terminate, parallel exports but could raise the prices of such products as exporters have to pay Turkish tariffs.

The Chinese government has removed trade restrictions on imports of coal from Australia. That followed limited imports earlier in 2023, although the Chinese National Development and Reform Commission has yet to confirm the restrictions’ removal.

– Australia’s coal exports fell by 15% in the fourth quarter of 2022 compared with the fourth quarter of 2019, according to S&P Global Market Intelligence GTAS data, largely down to the drop in Chinese exports, which had accounted for 22% of shipments in the fourth quarter of 2019. Exports to Japan increased by 23% to partly compensate, while shipments to the rest of the world were unchanged.

– Coal prices (Australia Newcastle FOB) are expected to drop by 34% in the second quarter of 2023 versus the first quarter of 2023, according to S&P Global Market Intelligence forecasts , before recovering by 11% through year-end.

– The Chinese government may implement a third year of cuts to crude steel production for 2023, according to press reports. It may also ban new capacity for manufacturing steel to mitigate greenhouse gas emissions and maintain prices.

Ten Central and South American countries will meet on Apr. 5 to negotiate inflation-reduction plans. These will include “getting rid of tariffs, eliminating red tape for imports, exports,” according to Mexican President Andrés Manuel López Obrador.

FedEx reported a 6% slide in revenue in the three months to Feb. 28 versus a year earlier, including freight volumes that fell by 19%. The company expects “volume declines will continue moderating” in the coming quarter. FedEx nonetheless increased its earnings guidance by 10% owing to accelerated cost-cutting actions.

– Digital freight forwarder Freightos has cut its revenue outlook for 2023 to growth of 15%-21% year over year from the equivalent of 87% previously. The firm has noted that “the freight industry [is] going through a contraction phase,” and that there has been a “very dramatic change” in industry dynamics, leading its competitors’ revenues to be “down 60% or 70%.”

– Container shipping rates for routes out of mainland China are now down by 22% year to date and 82% from their peak but are still 20% above the 2019 average.

– There are early signs of cost cutting in the freight industry to deal with falling rates. US payrolls in the logistics sector (air, rail, water, trucking, couriers, warehousing and support) fell by 0.3% sequentially in February, led by a 0.5% dip in support services. That has still left employment 2% above a year earlier and 20% above December 2019.